Take the full advantage of our new Corporate Expense card which offers you greater spending flexibility over your shopping. The UK2NAIJA Expense Card is a GBP (£) denominated debit card.

Get the premium benefits: (i) unrestricted access to all UK merchants/stores; (ii) unlimited spend limits; (iii) Anti-fraud security features and much more....

Get the premium benefits: (i) unrestricted access to all UK merchants/stores; (ii) unlimited spend limits; (iii) Anti-fraud security features and much more....

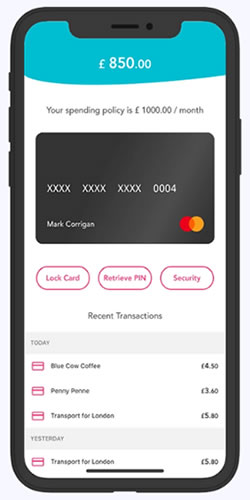

The Smart Debit Card

Pay your way and increase control with the UK GBP/£ denominated MasterCard.

Unlimited Benefits

Monthly spend limits up to £100,000. 5% cash back. No extortionate FX and much more...

Security as Standard

Flexible security gives you true peace of mind. Instantly freeze, or 3D secure.

Your simplest & smartest way to Shop

UK2NAIJA Expense card designed with you in mind.

Acceptance for Payment - Can be used to pay for goods and services from all UK merchants/stores.

It does not matter if the store only accepts UK issued credit/debit cards; with your UK2NAIJA Expense card you can now make payments at all UK merchants/stores. No more restrictions accessing millions of great products and special offers available!

Shopping Tip: When making online payments, you'll need to use the UK billing address assigned to your UK2NAIJA Expense card.

All of the benefits, none of the hassle

Unlimited features & benefits owning a UK2NAIJA Expense card

Pay your way! Save time and increase control with the UK2NAIJA Expense card.

- Acceptable for payment at all UK merchants/stores.

- Unlimited spend limits.

- Control spending by setting budgets, restricting ATM withdrawals and online transactions.

- Increase security and reduce fraud with instant spending notifications, 3D secure and remote card-locking.

- Automated accurate expense reports are created instantly. Cardholders can add receipts, more details and submit them all in-app, in seconds, on the go!

- No charges for Online or POS Terminal Transactions.

- Instant card top-up.

- Accessibility gives the customer 24-hour access to cash from ATMs globally.

- Safety - Employs the use of Chip and PIN technology to guard against un-authorized transactions.

- UK billing address.

- Issuance within 7 days.

- No paperworks required.

- Free delivery to your doorstep in Nigeria.

Card Tip: The company payment card that automatically tracks all expenses.

The UK2NAIJA Expense card is a GBP denominated Corporate debit card issued in partnership with FCA & MasterCard Worldwide.

Sounds good to me.

What's the cost?

| BASIC | GOLD | PLATINUM | |

|---|---|---|---|

| Set-up (Existing Customer) | £10 | £15 | £20 |

| Set-up (New Customer) | £20 | £25 | £30 |

| Monthly Maintenance | £12.50 | £15 | £20 |

When do I get my UK2NAIJA Expense card?

Your UK2NAIJA Expense card will be dispatched to your registered address in Nigeria within 7 business days once your application/payment is received and approved.